🇨🇦 Consensus 2025 Toronto Crypto Reflections

Signal, structure, and some surprisingly grounded momentum

Consensus 2025 What Stuck

This year felt different. Less noise, more maturity. You could sense the AI x Crypto narrative overtaking everything, but underneath it all, builders were asking better questions about business models, UX, and what "compliance" really looks like in an on-chain world.

- AI x Crypto was everywhere, but useful integrations were still early. Projects like Kite AI stood out by natively blending agents with blockchain rails.

- Autonomous agents drew hype but trust, privacy, and UX are what'll actually make them usable.

- TradFi isn't circling anymore it's here. Institutions are integrating, not experimenting. RWAs and stablecoins are becoming native assets, not side projects.

- Institutional adoption + better UX is now the combo to beat. Retail needs onboarding, institutions need clarity. Builders are finally addressing both.

- Compliance is evolving. Not disappearing just getting smarter. Chainlink's Nazarov laid it out: smart contracts + oracles = automated enforcement. Lower cost, higher auditability.

- Top founders weren't pitching they were shipping. Some of the strongest product stories came from booths with no flashy decks.

- Revenue is back in fashion. Speculation isn't dead (hello, memecoins), but serious builders are talking value flow, not just tokenomics.

- Main L1s are stabilizing. No flood of new chains. Solana, Ethereum, Bitcoin, Sui all carving clearer lanes. Bitcoin's BIP-360 post-quantum work was quietly huge.

- Decentralization isn't trendy, but it's still looked after. The real builders haven't forgotten what matters.

My favorite takeaway? We're not in a hype cycle anymore not really. We're in a structure cycle. Infrastructure is finally catching up to ambition. People are building things that work, even if they're not going viral.

Diving Deeper

🏛️ Stablecoins & Regulation

- Kevin O'Leary (O'Leary Ventures):

- Said regulation will cleanse crypto — compared it to "doing dialysis in UAE: uncomfortable but necessary."

- Warned about "shitcoins" and advised watching portfolios carefully.

- Praised exchanges for being profitable regardless of market cycle.

- Advocated for Bitcoin and stablecoins as the only assets institutions currently trust.

- Highlighted HBAR (Hedera) for utility and mentioned it positively.

- Eric Trump:

- Delivered a passionate, unscripted speech condemning the traditional banking system as broken and politically weaponized.

- Stressed how debanking affected his business despite clean records: "If they can cancel us, they can cancel anyone."

- Supported crypto for offering transparency, speed, and freedom from bureaucratic restrictions.

- Praised USD1 and World Liberty Finance efforts, linking them to the broader political and financial reform narrative.

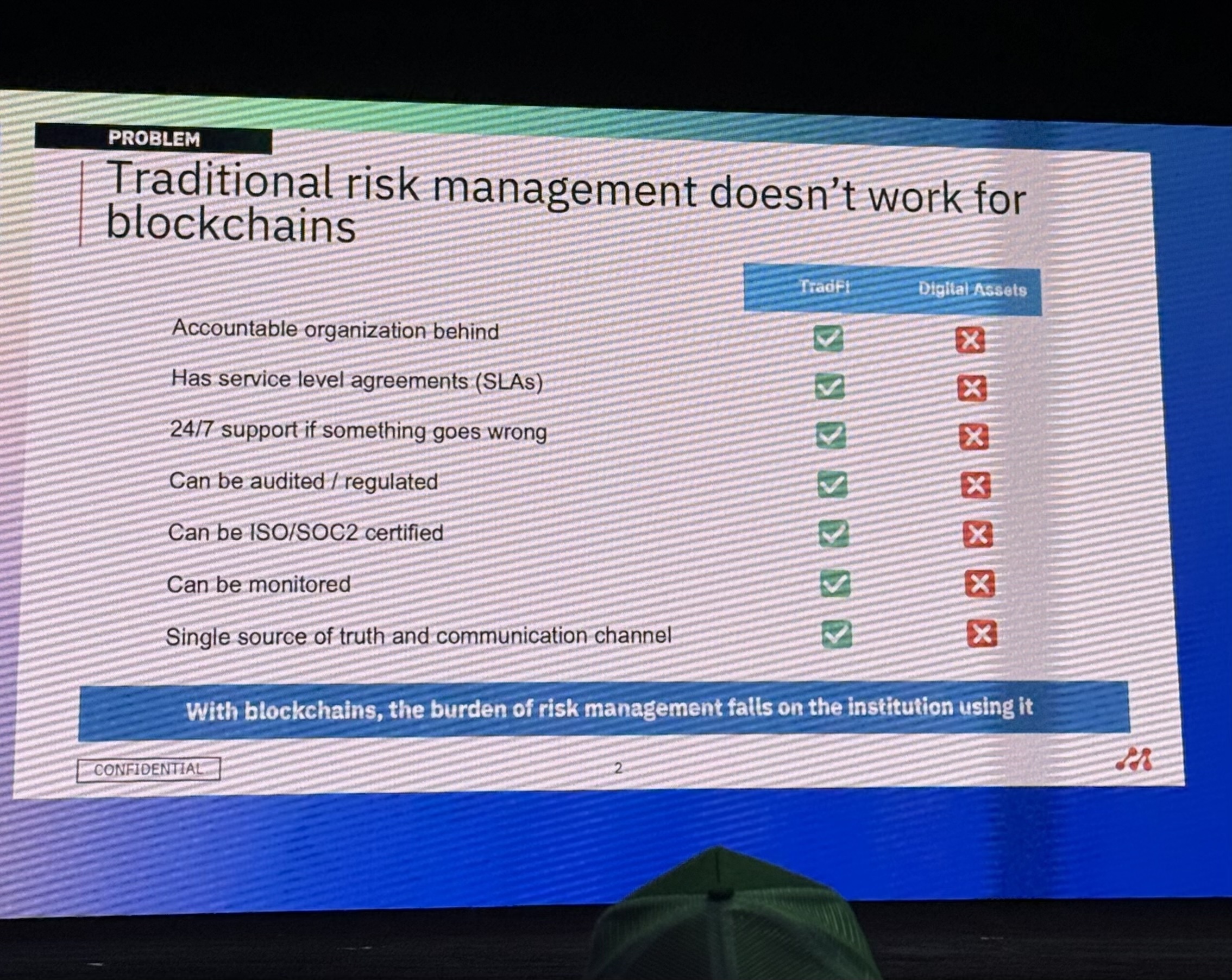

- Sergey Nazarov (Chainlink):

- Argued for "automated, on-chain compliance" using smart contracts + oracles.

- Framed compliance not as a threat, but as a feature and competitive advantage.

- Explained Chainlink's CCIP and role in building verifiable compliance layers with transparency and trust.

- GENIUS Act:

- The bill aims to create a regulatory framework for payment stablecoins in the US with 1:1 reserve mandates and transparency measures.

- On May 19, the bill passed a procedural Senate vote (66–32), awaiting final post-Memorial Day vote. This was a topic while the conference was happening (before this vote) given it had previously passed the House of Representatives but failed to pass a key Senate vote on May 8.

- Seen as a major enabler for institutional clarity, unlike temporary executive orders, legislation offers permanence.

- Discussion intensified around Consensus due to timing and ties to stablecoin ecosystem maturity.

- The stablecoin regulatory landscape is dominated by two bills: the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) and the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy). The bills at a high level are fundamentally the same. Read more them here.

🤖 AI and Web3 Integration

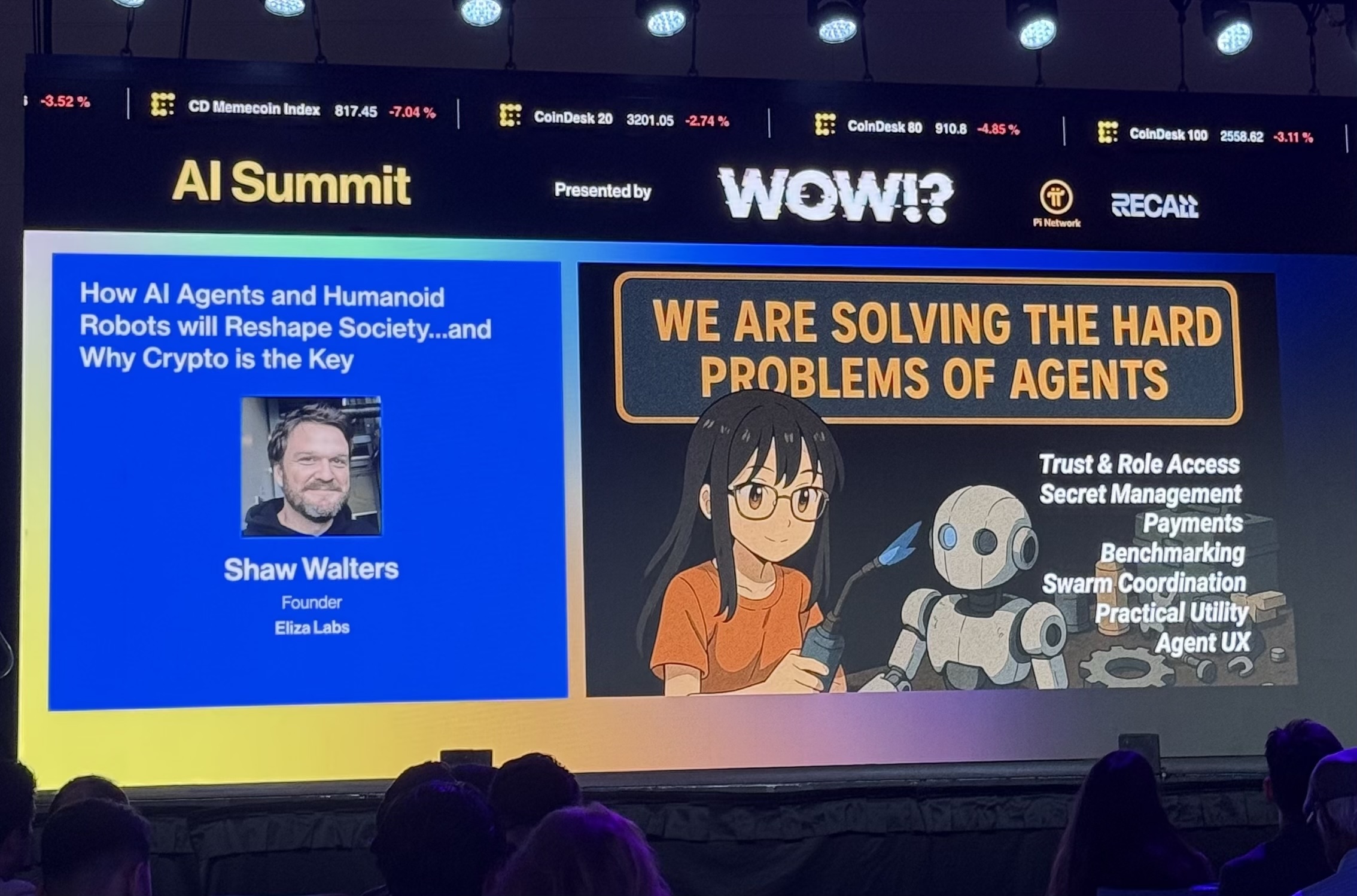

- Shaw (Eliza Labs): Argued that for agents to function autonomously, they need crypto-native primitives — identity, memory, and trustless payments. Positioned crypto as the foundational infra for scaling agentic AI.

- Lei Lei (KiteAI): Emphasized users don't care about decentralization per se — what matters is how centralized actors use personal data. Framed decentralization as more relevant to enterprises and long-term infrastructure than end users.

- David Fields (ReadyAI): Said it plainly: "Decentralization is a feature, not a bug." Highlighted how ownership of data and compute is key for enterprise AI adoption and trust.

- Eric Winer (NEAR AI): Explained that smart contracts act as the UX layer for AI agents, enabling negotiation, execution, and validation. Advocated for subscription models over per-use metering — more intuitive for users. Reinforced stablecoins as payment rails for agents to interact with systems and services.

- Two projects that caught my attention for real-world AI x Web3 integration: Both exemplify practical infrastructure and avoid inflated narratives, signaling how AI can build atop crypto rails meaningfully.

- DeFi x AI (DeFAI): Talks at "Hot DeFAI Summer" revolved around how autonomous agents could interface with DeFi protocols, from trading to lending. Key challenges highlighted included:

- Verifiable identity, AML/KYC frameworks, and rate-limiting logic.

- Ensuring agents don't exploit or manipulate on-chain systems.

📊 Infrastructure, Capital & Institutional Entry

- John D'Agostino (Coinbase):

- Discussed M&A, IPO readiness, and infrastructure's role in institutional capital inflow.

- Called the Deribit acquisition a "killer move" that strengthens crypto's option and futures stack.

- Emphasized quality over quantity in crypto IPOs: "We don't need more — we need better."

- Stated that real infra is the foundation for token + equity exits.

- Kyle (Milk Road):

- Shared optimism about the cycle: "This isn't tokens vs. equities — it's growing the pie."

- Noted potential return of big tech (Shopify, Meta) into the space post-Libra.

- Argued that hybrid models (token + equity) represent the future of sustainable Web3 business models.

- Startup Village - The VC View:

- William Mougayar emphasized: "A token is an enabler of a business model."

- He praised Blackbird, a startup that starts with a points system and introduces a token only when strategically ready.

- Charlie Morris (CMCC Global) advised founders to follow up strategically: "If it's a no, pace updates, don't pester. Even silence means the door isn't shut."

- He encouraged finding investors beyond crypto Twitter — like vintage car shows — and maintaining energy and storytelling clarity.

- BTC vs AI/HPC. Mining Pivot?

- Bitfarms explicitly shared its pivot toward High-Performance Computing (HPC) and AI, leveraging its power infrastructure and facilities.

- Marathon Digital (MARA) did not announce a move into AI/HPC. Instead, its CFO (Salman Khan) focused on optimizing mining with low-cost, intermittently-powered setups (like wind-powered sites) and holding BTC on the balance sheet — no mention of HPC transition.

- Cathedra Bitcoin's Drew Armstrong described their focus on rack space and power infrastructure, viewing AI/HPC demand as a byproduct of miners' excess compute capacity, not a strategic pivot. Their model remains "long rack space, long Bitcoin."

- As water, space, and energy infrastructure become increasingly scarce and valuable, Bitcoin mining firms are eyeing AI/HPC data centers as a clearer path to predictable revenue. The trade-off? Both BTC and AI depend on power-hungry, high-demand systems — making this a strategic reallocation within the same scarce-resource battleground.

🧱 Miscellaneous Highlights

- Dave Portnoy (Barstool Sports):

- Delivered a humorous, self-aware talk reflecting on the memecoin hype cycle.

- Famously said: "Trenchers don't need protection from the SEC — they need protection from themselves."

- Talked about launching (and abandoning) Greed 1 and 2 after experiencing real-life backlash and personal reputational risk.

- Shared lessons from the Argentina memecoin scandal, acknowledging how addictive and chaotic the degenerate trading scene can be — but also why he won't launch Greed 3 despite the demand.

- Tied into a broader theme: speculation culture is still rampant, but even its most vocal promoters are pulling back due to real-world consequences.

- RWAs:

- Attended a few side events where the tone was very grounded — infra, legal, DeFi liquidity, cybersec, and accounting firms.

- Private equity likely leading the RWA push.

- "Bridging off-chain assets to benefit from on-chain usability" — not just marketing fluff.

- Bitcoin Post-Quantum (Hunter Beast):

- Talk on BIP-360: introduces SegB3 (bc1r...) and soft-fork plans for quantum-resilient cryptography.

- Contrast drawn with Ethereum's QNA plan, which could break legacy keys and require hard forks.

- Project Marketing vs Tech Substance:

- Flashy booths from Fastex and Spacecoin lacked accessible tech detail.

- Strong capital deployment, but few technical docs or dev engagement.

- Visuals don't always equal product quality.

💭 Loose Thoughts

- Product Before Pitch

- A recurring issue in web3 world and that was somewhat highlighted in the conference is startups chasing funding without focusing on product.

- The common rat race of investment over building is widely noticed by VCs, and it's difficult to change that narrative without a revenue model or a sustainable plan.

- It is also important to note that multiple rounds of funding can be a double edged sword, as it can lead to dilution and a lack of focus on the product, while also creating a sense of urgency to deliver results and a mix between investors and founders that might not be fully aligned with the long term vision of the project.

- Modular Infrastructure:

- Infra discussions focused on combining execution and data availability layers more cleanly.

- I believe that Sui and Sonic are gaining more and more interest for balancing EVM/non-EVM tech, TVL growth, and tool maturity.

- Web2-Level UX is Key

- The need for Web3 apps to adopt Web2 usability standards was repeatedly emphasized:

- Seamless logins (zk, social, etc.)

- Stable payment flows

- Chain/account abstraction

- UX should match the expectations of enterprise partners and regular users.

- Delayed Tokenization (Blackbird)

- Blackbird's model of delaying token launch until product-market fit and user incentive alignment are clearer is emerging as a trend worth following.

- Macro Cycle Sentiment Shift

- The overall framing of the conference suggested a transition into a post-speculation era (hopefully).

- There is less noise and more structure. Builders, investors, and users are increasingly asking for real mechanics, not just narratives.

Until next year. Stay building.

This isn't financial advice. Just impressions from a week in Toronto trying to filter signal from marketing.